year end accounts extension

Wont be eligible for another 3 months. Gather and analyze financial statements.

Understanding Profitability Ag Decision Maker

Your accounting books should be organized up-to-date and ready for the transition into a new year.

. The Comptrollers office will grant an extension of time to file a franchise tax report upon receipt of a timely request. Should the request not be forthcoming the FCA is able to impose a unilateral suspension. It is currently in administration.

Companies can apply for an extension of time of 60 days to file the annual return. However it is possible to lengthen your year end more than once within a 5-year period if your business meets one or more of the following. 03rd Jul 2020 1101.

Issuers subject to DTR4 are required to publish their annual financial reports within 4 months of their financial year-end DTR 413R. As it requires up to 14 working days to process the application you are advised to submit the EOT application more than 14 working. Replying to lionofludesch.

However if the companys year end was 26th February 2019 then the accounts will be due for filing. Preparing and filing. For funds with an annual or half-yearly accounting date on or before 31 August 2020 the temporary relief will remain in place.

If it shortens its first accounting period to 31st December 2017 then its accounts will still be due for filing by 25th December 2018 as this is later than 3 months after the new accounting period which would. You will also need to file a directors report unless your company is a micro-entity. So for example if the companys year was 30th April 2019 then the accounts will be due by 31st January 2020.

An extension of time to file annual return is applicable only to companies with financial year ending on or after 31 August 2018. If they have shortened by 1 day already in order to gain 3 months to file they will only be eligible for a 1 day extension for covid-19. Apply to extend your accounts filing deadline Use this service to apply for more time to file your annual accounts with Companies House.

Companies may change their year-end by shortening their financial year by a minimum of 1 day as many times as they like. The closing entries. Generally companies can lengthen their accounting period to a maximum of 18 months and unless certain criteria apply the financial year can only be lengthened once every 5 years.

Timely means submitted or postmarked on or before the due date of the original report. It felt like a weight off the shoulders when on 25 March 2020 an announcement with regards to deadline extension for company accounts filing was made. So if a company is set up on 25th March 2017 it will have a normal year end date of 31st March 2018 and its accounts will be due for filing by 25th December 2018.

Depending on the size of your company you. Yes Companies House say that the extension from 9 months to 12 months for a private limited company to file accounts at Companies House applies where the ordinary 9 month deadline would fall on or before 5 April 2021 and on or after 27 June 2020. Your financial statements are a lifeline for your small business.

It can only be lengthened to a maximum of 18 months in total. To do this you will need your company accounts and your corporation tax calculation. If they do not meet this deadline we expect issuers to request a suspension of their listed securities.

You will have 12 months to submit your accounts instead of the standard 9 months filing deadline. The accounts filing deadline was extended. The pandemic ignited widespread panic and a sudden pressure over remote working countrywide making the businesses wonder how the work would be managed.

Companies House will extend your filing deadline to 31 March 2021. The client I am working on has previously extended the filing deadline by reducing the year end by a day however. Private limited companies LTD accounts.

Different rules apply to lengthening the year end. Generally companies can lengthen their accounting period to a maximum of 18 months and unless certain criteria apply the financial year can only be lengthened once every five years. Filing Company Year End Accounts with HMRC.

You can shorten your companys financial year as many times as you like - the minimum period you can. The accounting reference date year end can be changed for the companys current financial year or the one immediately before it. The rules on changing your financial year end.

The closing entryentries is one that consists of clearing off all income and expense accounts this is commonly known as your Profit and Loss account which holds your current years trading activity. Now that businesses have had time to adjust to the changed environment we intend to end the temporary relief in stages over the coming months as follows. At the end of each trading year the balance on these accounts are transferred out to the balance sheet.

Your business is part of a larger parent company and. The date can be shortened as many times as you like with the minimum period you can shorten it by being one day. The automatic extensions granted by the Corporate Insolvency and Governance Act will come to an end for filing deadlines that fall after 5 April 2021.

Make sure you check these eight procedures off your year-end accounting closing checklist before the year officially comes to a close. In subsequent years the accounts will be due for filing at Companies House 9 months after the year end adjusted for the month end. The net amount of the balances shifted constitutes the gain or loss that the company earned during the period.

You will need to file your company tax return also known as the CT600 form online. If lengthening your year end. For examples a private limited company with an accounting year-end date of 31 March 2020.

United Kingdom June 12 2020. Once the year-end processing has been completed all of the temporary accounts have been. This extension includes dormant company account too.

It can only be lengthened once over a 5-year period. Companies may change their year end by shortening their financial year by a minimum of one day as many times as they like. In light of COVID-19 we review the steps a companys board of directors may now take to adapt the process for approving year end accounts.

At the end of the fiscal year closing entries are used to shift the entire balance in every temporary account into retained earnings which is a permanent account. Generally for an extension to be valid 100 percent of the tax paid in the prior year or 90 percent of the tax that will be due with.

Accounting For Senior Cycle New Fourth Edition 2021 In 2022 New Students Student Activities Textbook

When Are Taxes Due In 2022 Forbes Advisor

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition

Understanding Profitability Ag Decision Maker

/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Understanding Profitability Ag Decision Maker

Solo 401k Contribution Limits And Types

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

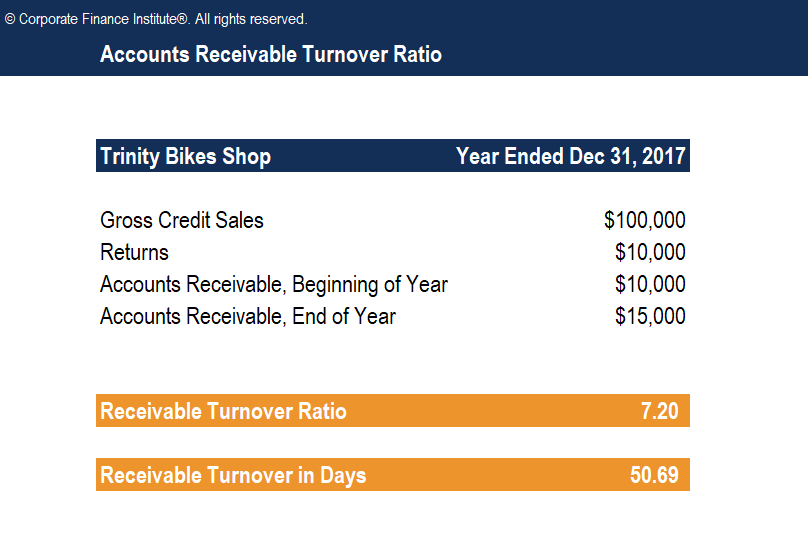

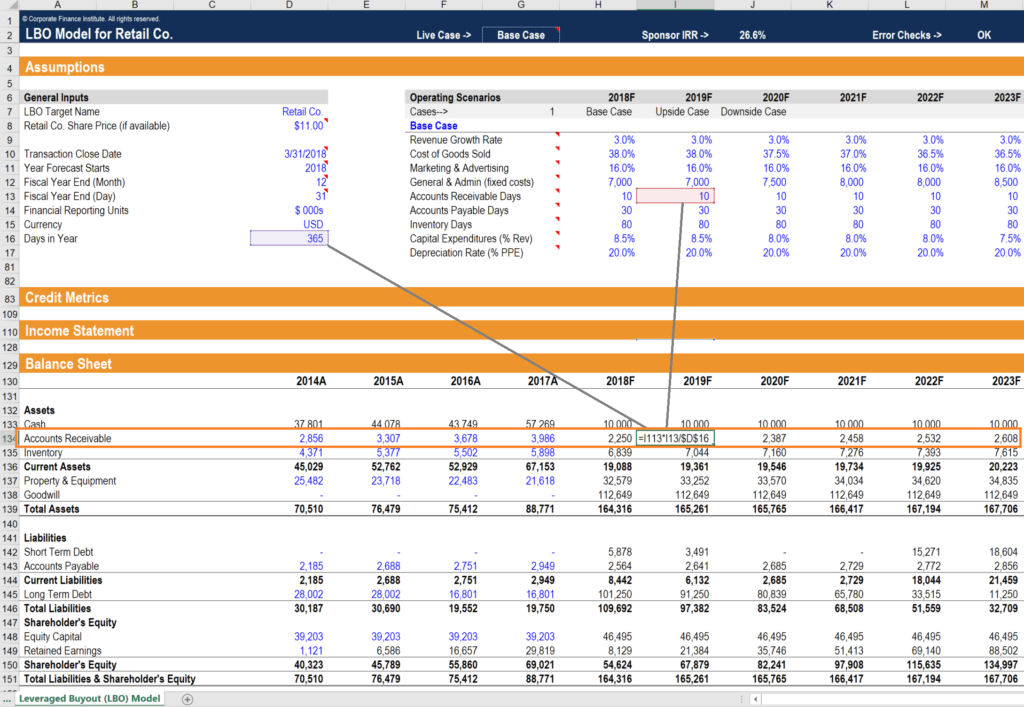

Accounts Receivable Turnover Ratio Formula Examples

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

2021 401 K Deadlines For Plan Sponsors Guideline

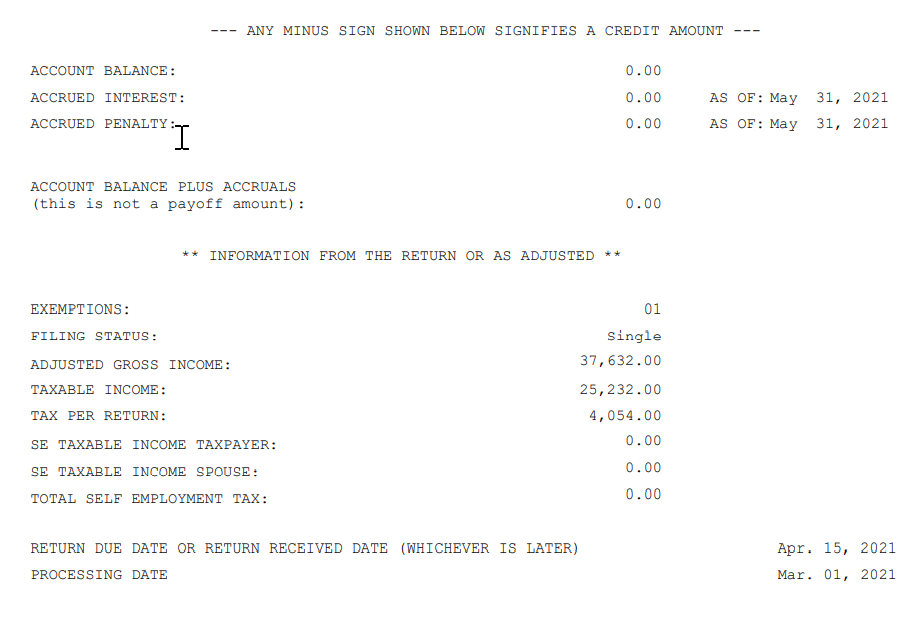

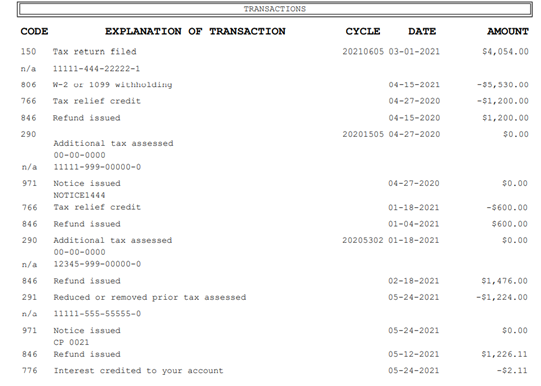

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Important Statutory Due Dates For Llp Annual Filing Fy 2020 21 Ebizfiling

Accounts Receivable Turnover Ratio Formula Examples

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

Accounts Receivable Turnover Ratio Formula Examples

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service