stash tax documents turbotax

1 online tax filing solution for self-employed. A simple tax return is Form 1040 only without any additional schedules.

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Americas 1 tax preparation provider.

. Choose the Tax Filing Expert For Your Job With Our Easy Comparison Options. Login to your Stash account. The 1099-DIV is a common form which is a record that Stash not your employer gave or paid you money.

1099-DIV 1099-B etc at the top of pg. Have a Retire account and made a contribution to it for the specified tax year. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

The Internal Revenue Service IRS can provide you with copies of your tax returns from the most recent seven tax years. You will receive an email when your tax forms become available. 1099-DIV Dividends and Distributions A 1099-DIV tax form is for getting paid on dividends.

Start For Free Now. You CAN import all your tax information into TurboTax from Stash. Ad File Your Tax Forms Online With Americas Leader In Taxes.

Navigate to the account type you are looking for documentation on. You can now directly import your Stash tax documents with TurboTax Premier. Want to simplify tax season.

Want to simplify tax season. Youll find your tax forms separated out by account. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Stash Capital LLC an SEC registered broker-dealer and member FINRASIPC serves as introducing broker for Stash Clients advisory accounts. And the best part. If these scenarios dont apply to you you.

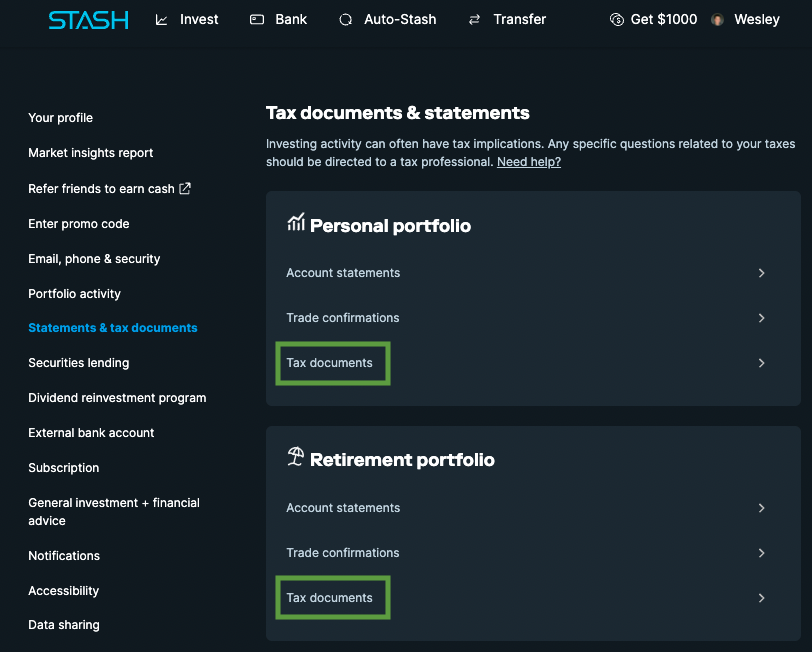

Click Tax Documents for each Stash account. The easiest way to do this is through the Stash app under SettingsStatements and DocumentsTax Documents. Click Tax Documents - now youve got the documentation you need to declare any income or loss you may have realized from the previous tax year.

If you earned more than 10 in dividends from your Stash investments youll receive a 1099-DIV. It includes a personal investment account the Stock-Back Card saving tools personalized advice a Roth or Traditional retirement account IRA 4 and 1000 of life insurance coverage through Avibra. Stash issues tax forms to people who.

Earned more than 10 in dividends andor interest. 1 online tax filing solution for self-employed. Select Statements Tax Documents from the menu on the left.

Based upon IRS Sole Proprietor data as of 2020 tax year. Now youve got the documentation you need to declare any income or loss you may have realized in your Stash. Get started with a StashStockParty disclosures.

You can access historical documents year round in the Tax Documents section of Account Management. The above link should take you to your documents. What Tax Forms Does Stash Send.

The above link should take you to your documents. Limited interest and dividend income reported on a 1099-INT or 1099-DIV. Have made money from selling investments.

See How Easy It Really Is Today. 0 Federal 0 State 0 To File offer is available for simple tax returns only with TurboTax Free Edition. Tax Filing Is Fast And Simple With TurboTax.

Heres how you can find your Stash account number during TurboTaxs Direct Document Import. Dont panicwe make it look easy. Stash is not a bank or depository institution licensed in any jurisdiction.

Invest in yourself. 1 best-selling tax software. Form 22102210AI Underpayment of TaxAnnualized Income.

On the next screen enter Apex into the field titled Im looking for and then select Apex Clearing Corporation. And heres a bonusTurboTax offers Stashers up to 20 off federal tax prep. Americas 1 tax preparation provider.

Now you can automatically upload your Stash tax documents with TurboTax. Have 2021 tax documents shown up in anyones account yet. Stash is not a bank or depository institution licensed in any jurisdiction.

Up to 20 off TurboTax. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. As one of our subscribers youre eligible for up to 20 off federal tax prep when you file with TurboTax.

Now you can automatically upload your Stash tax documents with TurboTax. After starting a New Tax Return from the File menu select Import then From Financial Institution. 1 best-selling tax software.

Its officially TaxSeason. QTurboTax Webinar for Stashers 2102022. Great news if you are using TurboTax to file your taxes this year TurboTax will allow you to share your Stash account information and directly import your tax documents into TurboTax.

Ad Compare Tax Preparation Prices and Choose the Best Local Tax Accountants For Your Job. Advisory products and services are offered through Stash Investments LLC an SEC registered investment adviser. Up to 20 off TurboTax.

Only enter account numbers for Stash accounts with 2021 tax documents listed. You may not have 2021 tax documents for. Now you can automatically upload your Stash tax documents with TurboTax.

Based on aggregated sales data for all tax year 2020 TurboTax products. Based on aggregated sales data for all tax year 2020 TurboTax products. Copy or screenshot your account number and type of tax document is.

Stash will make your relevant tax documents available online on or before. Enter number of returns. Once youve logged in you can also click on your name in the top right corner of the screen select Statements Tax Documents and then Tax Documents.

Claiming the standard deduction. What Tax Forms Does Stash Send. Review the tax documents provided by Stash.

1099-DIV 1099-B etc at the top of pg. If you didnt get an email about tax forms and arent seeing any in your account its because you dont need them for this tax year.

How To Get Your Stash Bank Account Statements Youtube

Turbotax Direct Import Instructions Official Stash Support

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Hackers Spoof Fintech Apps To Profit From Tax Season Cybernews

Start Investing With Just 5 Join Millions Of Americans Who Use Stash To Invest Learn And Save Zero Add On Trading Investment App Stash App Investing Apps

Stash Review Pros Cons And Who Should Open An Account

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Turbotax Direct Import Instructions Official Stash Support

Stash App Taxes Explained How To File Your Stash Taxes Youtube

R Snap Tap Done Get Your Taxes Done Right Anytime Anywhere 0 Fed 0 State 0 To File Absolute Zero Fed Free Ed The Turbo Turbotax App Tax Refund

Stash Review Pros Cons And Who Should Open An Account

Stash 1099 Tax Documents Youtube

Hackers Begin Spoofing Fintech Apps As Tax Season Approaches

If I Don T Recieve A 1099 B From The Stash App Do I Still Report Anything On My Taxes Stash Website Says That If You Opened Your Account In The Last Year They

Turbotax Direct Import Instructions Official Stash Support

Hackers Spoof Fintech Apps To Profit From Tax Season Cybernews

Turbotax Direct Import Instructions Official Stash Support